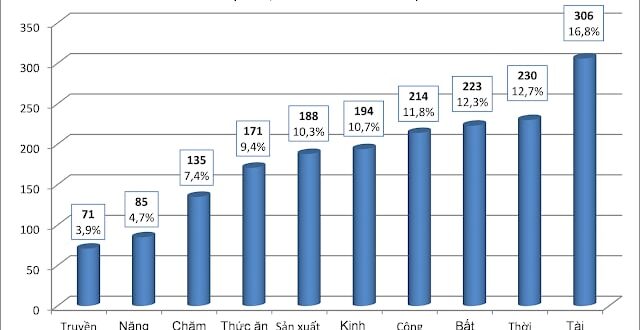

Nếu bạn có ước mơ trở thành tỷ phú, hay đơn giản hơn là làm giàu, đây là những công việc gợi ý cho bạn! Tạp chí Forbes đã công bố danh sách tỷ phú thế giới năm 2021. Năm nay, toàn cầu ghi nhận kỷ lục 2.755 người có …

Xem thêm »Chuyên gia nghiên cứu sự bùng phát bệnh đậu mùa khỉ: Khả năng có phương thức lây nhiễm mới

Gần đây, vào thời điểm dịch bệnh COVID-19 giảm dần ở Âu Châu và Hoa Kỳ, thì một căn bệnh truyền nhiễm khác đã xuất hiện. Hàng chục trường hợp được xác nhận hoặc nghi ngờ mắc bệnh đậu mùa khỉ (Monkeypox) đã xuất hiện ở hơn 10 quốc gia …

Xem thêm »Diễn văn thức tỉnh triệu người của tỷ phú Jeff Bezos: “Cuối cùng, cuộc đời chính là sự lựa chọn của chúng ta”

“Nếu thất bại, tôi sẽ không hối hận về điều đó nhưng tôi biết mình có thể sẽ hối hận nếu không thử.” – Jeff Bezos, Chủ tịch sàn thương mại điện tử lớn nhất thế giới Amazon. Thất bại không quá tệ như bạn nghĩ, chúng ta luôn rút ra được …

Xem thêm »Bác sĩ người Nhật 56 tuổi nhưng mạch máu khỏe như 28 tuổi nhờ uống 3 loại nước quen thuộc

Ít ai ngờ rằng, vị bác sĩ người Nhật nhờ uống 3 loại nước đã cải thiện sức khỏe mạch máu, còn giúp vẻ ngoài trẻ trung hơn người đồng trang lứa. Bác sĩ Toshiro Iketani là một chuyên gia nổi tiếng về hệ thống tuần hoàn trong cơ thể. …

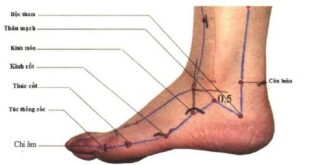

Xem thêm »Huyệt giải khê: Vị trí, cách xác định và tác dụng của huyệt

Huyệt giải khê tập trung kinh khí mạnh nhất nên được y học cổ truyền đánh giá rất cao về tác dụng. Mặt khác, vì huyệt nằm ở phần chân nên rất dễ xác định vị trí cũng như tác động vào để hỗ trợ cho việc châm cứu, xoa …

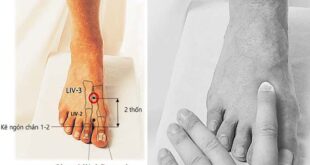

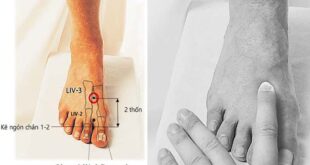

Xem thêm »Huyệt Thái Xung là gì? Vị trí ở đâu và châm cứu huyệt thế nào?

Trong hệ thống huyệt đạo, huyệt Thái Xung là một trong những huyệt được ứng dụng phổ biến trong giới Y học cổ truyền. Huyệt này ở trên đường kinh Can nên có khả năng ký huyết, bình can, can thanh hỏa, giúp điều trị tốt bệnh lý về gan. …

Xem thêm »Huyệt Côn Lôn: Hình ảnh, xác định vị trí, cách châm cứu bấm huyệt

Huyệt Côn Lôn có ý nghĩa từ tên của ngọn núi nổi tiếng ở Trung Quốc. Đây là một trong những huyệt đạo thuộc Bàng Quang Kinh có công dụng chữa trị liệt chi dưới, đau thần kinh tọa và nhau thai không xuống. Bài viết này sẽ thông tin …

Xem thêm »Bức thư trăn trối cuối cùng của Steve Jobs: 5 sự thật buộc phải chấp nhận, 6 bác sĩ tốt nhất thế giới

Dù đã ra đi được 10 năm nhưng Steve Jobs vẫn luôn là là tấm gương để nhiều người trong chúng ta noi theo về mức độ thành công trong sự nghiệp cũng như trong cuộc sống. “Sẽ không có một ai như Steve Jobs. Chúng ta không thể trở …

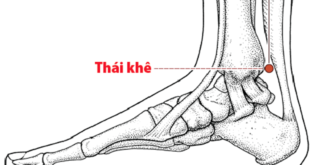

Xem thêm »Huyệt Thái Khê nằm ở đâu? Tác dụng chữa trị bệnh ra sao?

Theo Y học cổ truyền, huyệt Thái Khê là huyệt đạo được đánh giá rất cao trong việc điều trị bệnh vì tập trung kinh khí mạnh nhất. Song, vị trí huyệt ở chân nên huyệt khá dễ để nhận biết và kích thích, hỗ trợ đắc lực cho việc …

Xem thêm »Huyệt Thái Xung là gì? Vị trí ở đâu và châm cứu huyệt thế nào?

Trong hệ thống huyệt đạo, huyệt Thái Xung là một trong những huyệt được ứng dụng phổ biến trong giới Y học cổ truyền. Huyệt này ở trên đường kinh Can nên có khả năng ký huyết, bình can, can thanh hỏa, giúp điều trị tốt bệnh lý về gan. …

Xem thêm » Okchances Rich Together

Okchances Rich Together